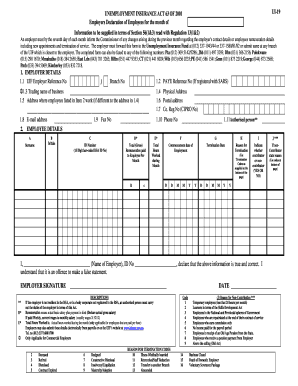

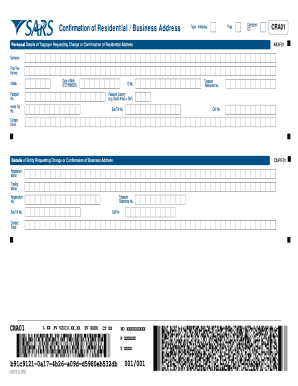

ZA SARS EMP101e free printable template

Get, Create, Make and Sign

Editing emp101 online

How to fill out emp101 form

How to fill out emp101e form:

Who needs emp101e form:

Video instructions and help with filling out and completing emp101

Instructions and Help about 2010 sars application registration print form

This is part 16 of angular 2 tutorial in part 14 of this video series we discussed one of the structural directives NGC in angular in this video we'll discuss another structural directive ng4 let's understand the use of this directive with an example so here is what we want to do is we have a list of employee objects here each employee object has got employee code name gender annual salary and date of birth, so we want to display these employee objects in an HTML table like this let's see how to achieve this using NG for structural director this is the same project that we've been working that so far in this video series we want our Employee List to be in its own component so to the employees folder let's add a new type script file let's limit employee list component dot TS let's click OK first let's create our component class export this keyword allows this component to be exported, so other components can import and use it if required class and in the name of our competent class let's name our class employee list component within these class let's include this property employees which contains the list of employee objects that we want notice that the moment we have set the type of the RA as any which allows any type of object to be added to this array it's not a very good practice because this array is not strongly typed now the reason we have used any is that at the moment we don't have a type for our employee object in a later video we'll discuss how to create strongly typed arrays for now let's include this employee's property within our Employee List component class to make this class an angular component we need to decorate it with component decorator for us to be able to do that we will have to first import component from angular core let's decorate this class with component decorator first let's set select a property I'm going to set selector to list — employee we can use the selector as a directive on an HTML page where we want to use this component we are going to have the view template for our component in a separate HTML file so to this employee folder let's add a new HTML file I'm going to name it employee list component dot HTML let's click OK now let's associate this HTML page as the view template by using template URL property, so template URL is our Employee List dot component dot HTML along the same lines let's encapsulate all the styles that are specific to this employee list component in a separate style sheet so to the employee folder let's add a new style sheet, and I'm going to name it employee list dot component dot CSS now we need to associate this style sheet with our Employee List component using style URLs property within the view template of our employee component let's include an HTML table notice within the table element we have T head and T body within T head we have TH elements to display these headers on the top code name gender annual salary and date of birth within T body element let's include TR and on this...

Fill 2010 za sars payroll application registration form online : Try Risk Free

People Also Ask about emp101

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

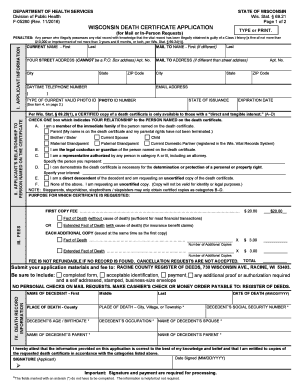

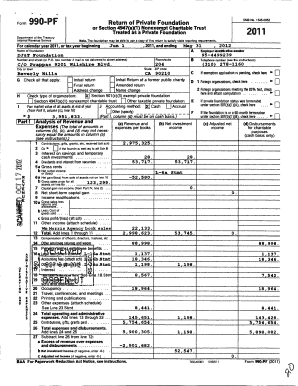

Fill out your emp101 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.